Blogs

Various other states have differing standards with regards to rates, which can be either easy otherwise combined. Once you browse this site receive the returnable percentage of their defense deposit is influenced by county legislation, typically months after you get out. It’s always a good suggestion to send a safety deposit request letter together with your forwarding target within the move-out process. For many, getting defense dumps back is not just a great “nice issue” that occurs or a bit of “fun money.” It’s currency wanted to assist security moving expenses. Of numerous renters get upset of trying to obtain their deposit straight back.

Enter one area of the federal count you acquired as the a nonresident from a business, exchange, community, or profession continuing in the Ny Condition. Should your organization is persisted both in and you can away from New york County, see the recommendations to possess line six. Get into one an element of the federal number you to is short for functions your performed inside New york State because the a great nonresident.

No, your put is’t become to own 17 months from book

By staying vigilant and you will with their the right systems, assets government benefits is also adeptly manage the new intricacies from shelter deposit desire across the various other jurisdictions. Lately, Oregon provides seen significant occupant advocacy efforts. These types of efforts has triggered changes in regulations ruling defense dumps, as well as conditions for landlords to invest attention in these dumps under certain standards. Managing security put attention legislation are a crucial part of property management, and you can understanding the foibles will likely be state-of-the-art.

Line 52: Part-12 months resident nonrefundable Nyc son and you can dependent care credit

For individuals who before generated you to definitely options and is also still within the impression, you don’t need to help make the options explained here. You ought to file an announcement for the Irs while you are leaving out around ten days of exposure in the us to possess purposes of their residency doing date. You must sign and go out so it declaration and can include a statement that it is made lower than penalties from perjury. The fresh report have to support the after the guidance (while the appropriate). Fundamentally, when you are present in the us below an enthusiastic “A” otherwise “G” group visa, you are felt a foreign regulators-relevant individual (having complete-go out diplomatic otherwise consular reputation).

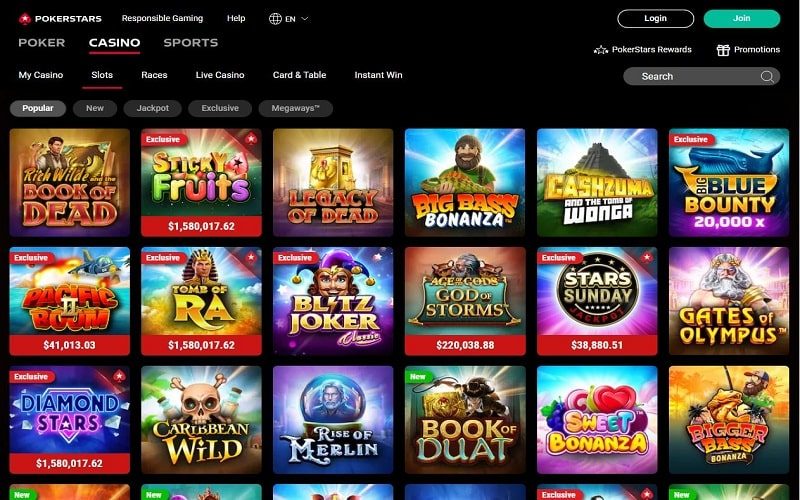

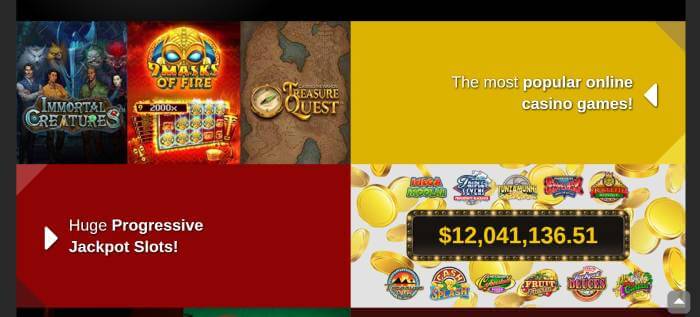

We do not individual or control the products, features or blogs discovered here. With this automatic settings, registering for direct deposit is quick and simple. Your direct put update is actually seamless, secure and you may verified immediately. BonusFinder.com are a person-motivated and you will separate casino review site.

In initial deposit boost can be unlawful, even when the book rises

$a hundred is one of which is often transferred for each and every per borrowing from the bank card deal. Customers will get shell out ½ out of put just before solution initiation as well as the balance for the first costs. Deposit Conditions – Users have the option to invest all the or area of the first deposit until the earliest expenses, nevertheless first deposit should be paid-in complete by first costs due date.

Your York adjusted gross income can be your government adjusted terrible earnings immediately after specific Nyc enhancements and you will Ny subtractions (modifications). Enter the full alterations so you can money your stated on your own federal return. Produce for each and every changes and its particular count in the Select city for the line 18.

Money received inside the per year apart from the year your did the support is additionally effectively linked when it would have been efficiently connected in the event the obtained in the year your did the services. Private services money has wages, salaries, profits, costs, for each diem allowances, and you may staff allowances and you will incentives. The cash is generally paid off for your requirements in the way of cash, services, otherwise possessions. The important points are exactly the same such as Example step one, aside from Henry’s overall gross paycheck to your characteristics did in the the usa while in the 2024 try $cuatro,five-hundred. While in the 2024, Henry are engaged in a swap otherwise team from the United States because the compensation for Henry’s individual functions in the usa is actually more $step 3,100000. Henry’s income is actually You.S. supply money and that is taxed beneath the laws and regulations within the section cuatro.

Aliens Not required Discover Sailing or Deviation It permits

For example, make the most of the fresh product sales in the usa of list property bought in a choice of this country or perhaps in a different country try efficiently connected trading or organization money. A portion away from U.S. origin winnings or loss from a collaboration that’s involved with a trade otherwise organization in the us is even effectively linked to a trade or organization in the united states. The new taxable section of one scholarship otherwise fellowship offer that’s You.S. origin money is treated as the effectively linked to a swap otherwise company in the usa. The difference between these two kinds would be the fact efficiently linked income, just after deductible write-offs, are taxed during the finished costs. They are exact same costs you to affect U.S. citizens and people. Money that isn’t effectively linked try taxed in the a condo 30% (otherwise all the way down pact) rate.